Complete Guide

Complete Guide

Accounts Payable Automation: The Complete Guide 2026

Everything you need to know about AP Automation: benefits, implementation, ROI and best practices for companies in LATAM.

Read article →AI agents that capture documents, validate against your ERP, execute approval workflows, and process payments automatically. Companies in Argentina, Chile, Brazil, and Mexico are already reducing AP time by 80%.

Three layers of intelligence working together to automate your operation.

Capture documents and automatically extract and digitize data from any source.

Connect Google Drive, Dropbox, SharePoint. Automatic monitoring of new files.

Automatic invoice downloads from utility and supplier portals.

Forward invoices to invoices@yourcompany.cedalio.com and they process automatically.

Manual drag & drop or API integration with your systems.

AI agents working 24/7 to process and validate data.

Automatically identifies document type and routes to correct workflow.

Automatically compares against public rate tables from regulatory agencies.

Identifies duplicates, unusual amounts, and suspicious patterns.

Connects to provider portals and automatically downloads invoices.

Generates automatic reports for finance, operations, and sustainability.

Automate repetitive and operational flows. No-code configurable.

Multi-level flows based on amount, department, supplier. Mobile approvals.

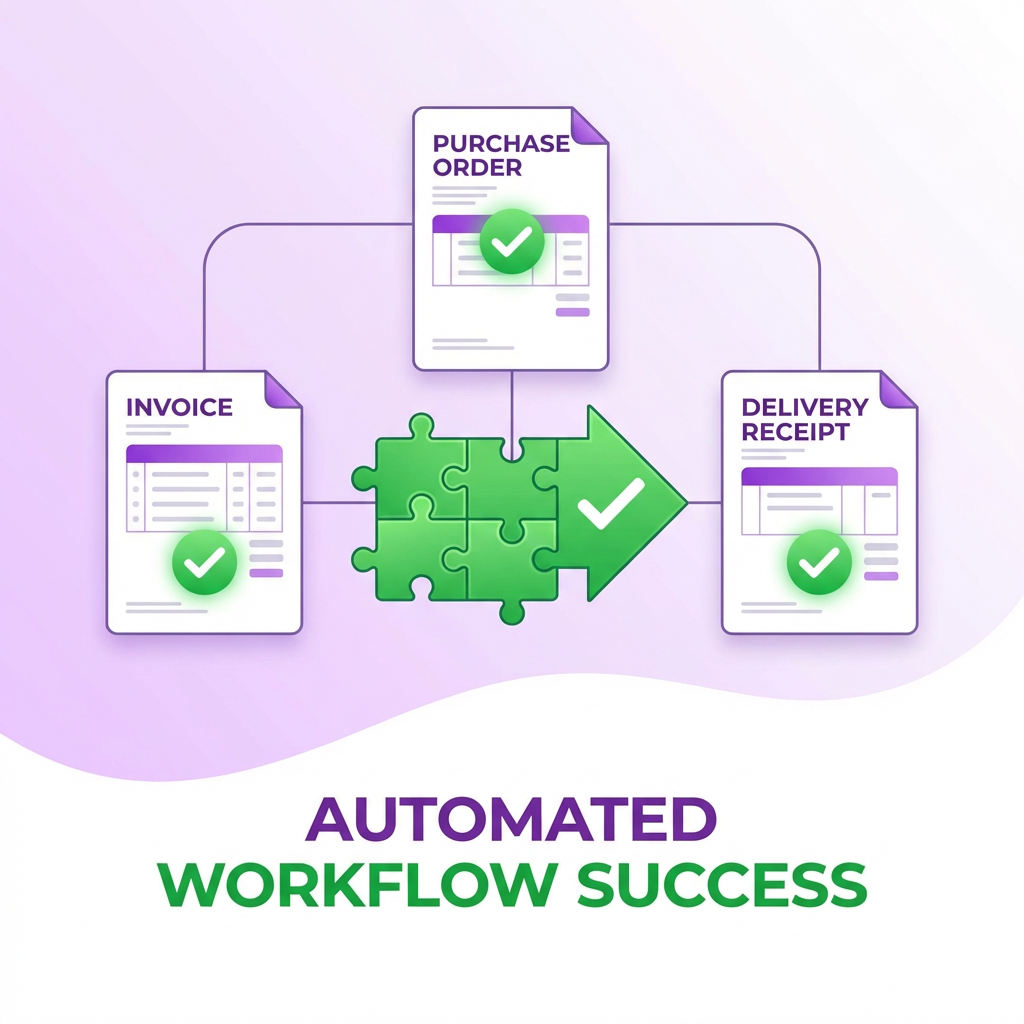

Automatic match: Invoice ↔ Purchase Order ↔ Receipt.

Automatic assignment of cost centers, projects, accounting codes.

Bidirectional sync with SAP, Oracle, NetSuite, TOTVS, Odoo and more.

Automatic verification with tax authorities. Compliance guaranteed.

From invoice to payment, everything in one place. Optimize your cash flow.

Visualize all your due dates. Avoid late fees and penalties.

Automatically capture early payment discounts. 2-3% savings.

Accelerate invoice collection. Integration with invoice finance partners.

The most comprehensive solution for companies with high volumes of public service invoices. Automate from download to payment.

Direct connection to major utility provider portals. No manual intervention.

View consumption by location, compare periods, detect trends and optimize costs.

Complete visibility by line item: taxes, regulatory charges, and rate components.

Notifications for unusual consumption, excess capacity penalties, or unexpected increases.

Complete visibility of payment flow before it reaches accounting. Real-time control without interrupting each company's operations.

Email, SharePoint, Drive, manual upload or photo. Everything centralized automatically.

PO, receipt, tax status, certificates. Everything verified instantly.

Rules by amount, expense type or supplier. Automatic escalation to committee.

Measurable results from companies that transformed their financial operations.

Schedule a 30-minute demo and discover how much you can save.

Request Free DemoSpecific workflows and validations for each sector.

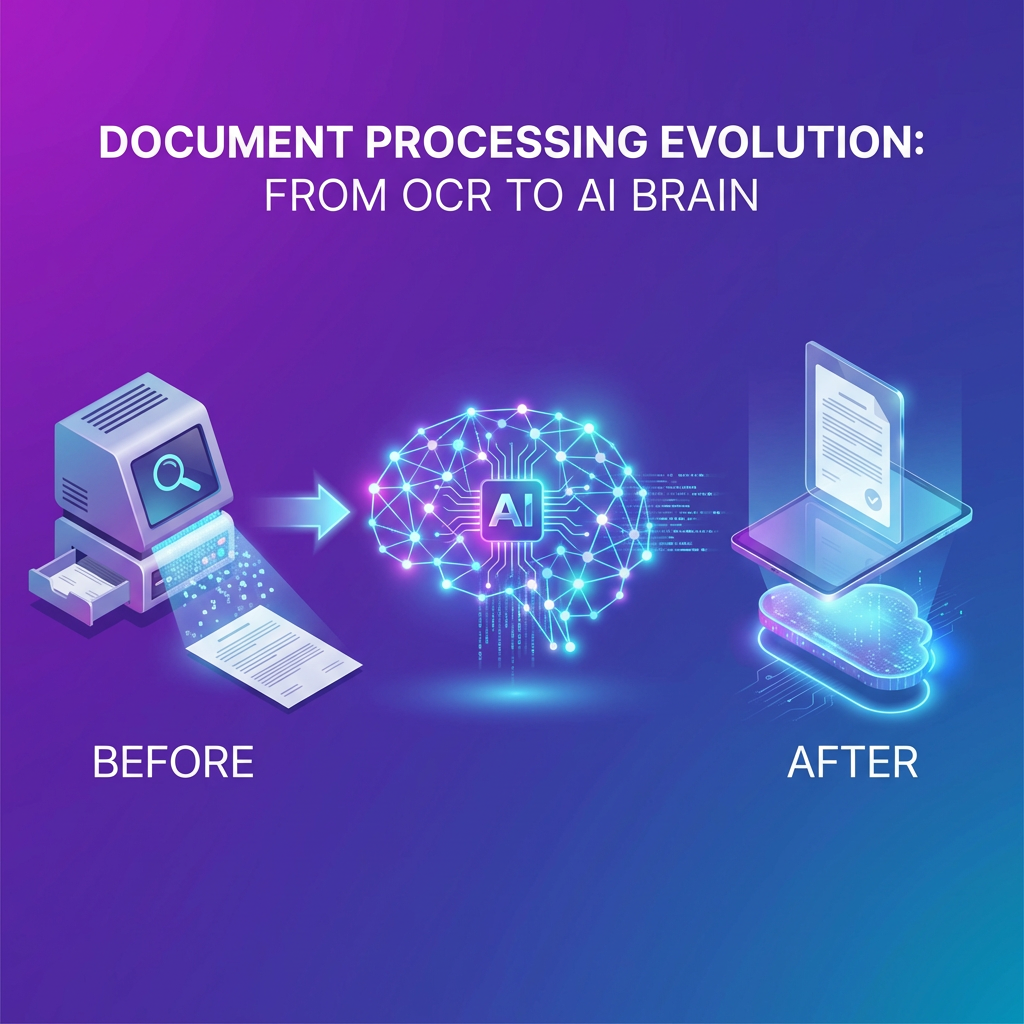

Cedalio uses AI-powered OCR technology that goes beyond traditional text recognition. Our system extracts structured data from invoices, purchase orders, receipts, and any financial document, regardless of format or quality. We process PDFs, images, scans, mobile photos, and electronic documents. The AI learns from corrections to continuously improve accuracy.

Traditional OCR only recognizes text in images. Cedalio goes much further: our AI agents understand the document's context, identify the type of invoice, extract specific fields (vendor, amount, due date, line items), validate against your ERP, execute business rules, and automatically trigger approval workflows. It's the difference between reading text and automating the entire accounts payable process.

Cedalio achieves 99% accuracy in data extraction thanks to multiple validation layers: AI-powered OCR, validation against master data, mathematical calculation verification, and cross-referencing with purchase orders and receipts. Key fields like tax IDs, amounts, dates, and line items are automatically validated. Additionally, the system learns from each manual correction to continuously improve.

Cedalio generates actionable insights in real-time: spending analysis by vendor, category, and cost center; anomaly and duplicate detection; cash flow projections; expiration alerts; utility consumption comparisons by period and branch; and team productivity dashboards. All reports are exportable and can be scheduled for automatic delivery.

Security is our priority. We are aligned to SOC 2 and in the certification process. All data is encrypted in transit and at rest. We offer Single Sign-On (SSO), two-factor authentication (2FA), granular role-based access control, complete audit logs, and the option for on-premise or private cloud deployment for Enterprise customers.

We have connections with major ERPs like SAP, Oracle, NetSuite, Microsoft Dynamics, TOTVS, and Odoo. If your ERP is not on the list, we offer bulk CSV upload and download for quick and frictionless integration. We also have a complete REST API and webhooks for custom integrations.

Typical implementation takes 1-2 weeks for mid-sized companies and 2-4 weeks for enterprise with complex integrations. We include assisted onboarding, historical data migration, team training, and dedicated support during go-live. Our Customer Success team guides you through the entire process at no additional cost.

Cedalio performs automatic validations against local tax authorities (tax IDs, withholding certificates, invoice authenticity), duplicate and anomaly detection, purchase order matching, and rate verification against public tariffs. All in real-time without manual intervention.

Our clients achieve 90%+ reduction in AP team workload, detection of thousands of dollars in anomalies and incorrect charges, identification of penalties and billing errors, and savings of several minutes per invoice in manual controls. Typical ROI is seen in less than 3 months.

With 1,000+ monthly invoices, Cedalio already makes sense. With 5,000+ invoices, it's a no-brainer due to time savings and error detection. It also applies to companies with multiple locations (200-300+ branches) even if per-location volume is lower.

Our customers typically recover their investment in less than 3 months.

Guides and best practices to optimize your financial operations.

Complete Guide

Complete Guide

Everything you need to know about AP Automation: benefits, implementation, ROI and best practices for companies in LATAM.

Read article → Utilities

Utilities

Proven strategies to optimize electricity, gas, and water invoices across multiple locations.

Read article → Technology

Technology

The evolution of data extraction: why AI agents outperform traditional OCR in accuracy and context.

Read article →Schedule a personalized demo and discover how much you can save.